Who we are

Since 1981, we’ve been the catalyst for growth and expansion, weaving success stories for over four decades.

Certified by the Small Business Administration, CCDC links borrowers with the best lending resources. These resources help give small businesses an advantage in today’s highly competitive marketplace.

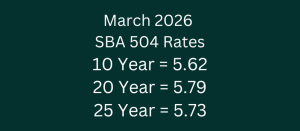

SBA 504 Rates

Click here to see the rate history of the SBA 504 Loan Program.

SBA 504 Program

Learn about how the SBA 504 program works.

Capital Confident

A webseries explaining business jargon for creating a dream business.

Tools

A list of resources for seasoned lenders and starting entrepreneurs.

Portfolio

BUSINESSES WE'VE HELPED

Since 1981, CCDC has supported the growth of small business owners by providing long term, fixed rate financing for capital expenditures.